Table of Contents

Introduction

Continental Currency Services – A currency exchange is a qualified business that allows customers to exchange one currency for another. Currency exchange of physical money (coins and paper money) is usually done over the pawn at a teller station, which container be found in numerous places such as airports, banks, hotels, and resorts.

Also identified as a “bureau de change” or “casa de Cambio,” a currency exchange should not be muddled with the foreign exchange (forex) market where traders and financial institutions transact in currencies.

How a Currency Exchange Works – Continental Currency Services

Currency exchange businesses, both physical and on, allow you to exchange one country’s currency for another by executing buy and sell dealings. The amount you can buy depends on the international exchange rate, a variable daily value determined by a network of banks. For sample, if you have US dollars and cannot talk about Australian dollars, take your US dollars (or credit card) to an exchange office and use them to buy Australian dollars.

Money changers change exchange rates at a fixed rate to ensure profits in their transactions. Suppose the spot rate for exchanging US dollars for Australian dollars is 1.2500 for the day. If you trade at spot rates, you can buy A $ 1.25 for every US $ 1 spent. However, the exchange can change this rate to 1.20. This means you can buy AUD 1.20 for the US $ 1. With this fictitious rate change, their price is effectively 5 cents per dollar.

What are the services of currency exchange?

Bureau de change are licensed businesses that allow customers to exchange one currency for another. Currency exchange for real money (coins and notes) is usually done at ATMs found in various seats such as airports, banks, hotels and resorts.

Does Continental currency exchange charge a fee?

Always get Continental’s best-guaranteed exchange rates with no unfair commissions. Personal and business money transfer services are available. Securely send money and savings to a Canadian exchange company.

Continental Currency Exchange has partnered with the best payment companies globally to ensure you can send money quickly and securely wherever you send it. Send multiple currencies around town or the world and always guarantee reasonable exchange rates at low rates. Sending money to Continental is simple and safe.

Why Transfer Money with Continental:

- Continental’s international partnerships ensure that your money arrives safely, quickly and securely

- Always get Continental’s guaranteed best exchange rates with no unreasonable commissions

- Personal and business money transfer services are available

- Send money with the security and savings of Canada’s currency guide

What is the continental currency called?

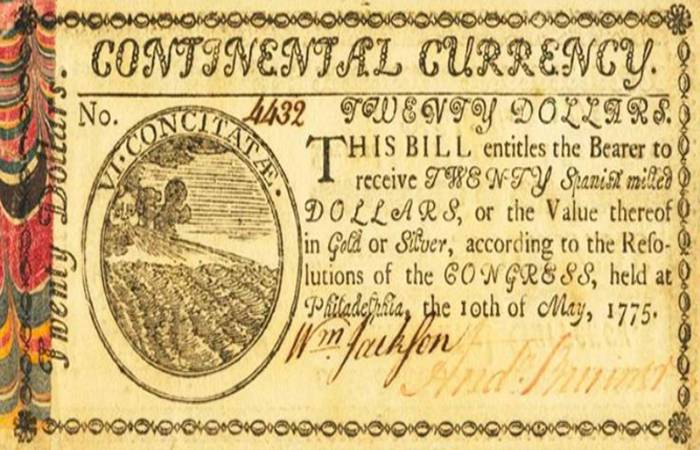

The Continental Congress issued continentals banknotes in 1775 to fund the American Revolutionary War. Continental notes depreciated rapidly because they were not back by physical assets such as gold or silver, and too many banknotes were print.

Understanding Continentals

Specifically, continentals, as newly mint colonial paper money call, were an issue from 1775 to 1779 to finance the cost of the war. The currency rapidly lost value, partly because it is not back by a physical asset like gold or silver, but also because too many banknotes were printed—these two factors paid to the coining of the derogatory term “not worth a continental”.

Revolutionaries in the New World colonies floated continental, lacking the funds to wage a protracted battle against the British crown. In 1775, the Continental Congress allotted $2 million in paper letters of credit. Paper notes represented the first significant distribution of currency in the colonies and featured the images of revolutionary soldiers.

Worthless Continentals

Congress stopped issuing Continental notes in 1779. By 1785, Continental currency was so useless that people stopped accepting the notes as payment for goods or trade. Economic concerns plagued the young nation as its leaders faced paying off war debts. Leaders also had to establish the first financial organizations to reduce inflation and reinstate the value of the nation’s money.

To stabilize the cheap and correct the country’s financial problems, Alexander Hamilton proposed the idea of a national bank. The national bank would issue paper money and handle tax revenues and government debt, among other functions. His vision became a reality in December 1791 when the Bank of the United States opened in Philadelphia.

Can I buy Currency Delivery? Continental Currency Services

The online currency purchase service allows you to receive the travel card at your doorstep. With the online recharge function, you can recharge your card when you are abroad, through the Internet Banking application or iMobile with the desired currency from anywhere and at any time.

How can I buy currency online from another country?

Four easy steps to get Foreign Currency

- Choose your desired currency & amount. Select the currency and denomination you need to carry along.

- Enter traveller details & delivery option. Option to choose the doorstep delivery or branch picks up.

- Make a payment online.

- Get order confirmation.

The container I buy USD in India? Continental Currency Services

You can exchange USD for INR in the Republic of India at banks or RBI accepted exchange houses. To convert money in banks, you must have a bank account with them. They also custody a service fee, plus the exchange rate given by banks is not the best in the market.

History Of The United States Dollar

It was in 1775, 240 years meanwhile the United States continental congress authorized the issue of inland money. 16 ages later, on April 2, 1792, the United States Parliament bent the country’s standard unit of currency: the US dollar, which colloquially became the US dollar. You may be attentive to know that the word “dollar”, which is so popular, had already been in common use since the early colonial period.

World Main Reserve Currency Of The United States Dollar

The US dollar is arguably the most general currency in the world. The popularity of the US dollar speaks for itself and can use in tons of international transactions. Since it is the world’s main reserve currency, you can exchange your US dollars for the local currency of the nation you are in. If you cannot get the local money you intend to travel to, you can buy US dollars for Indian rupees.

Convert Dollar To Rupee

The fact that speaks volumes about why the exchange is so popular is that around 3.1 million NRIs live in the US. With such a large Indian populace residing in the US. It is pretty apparent how much currency exchange must be happening. This is because exchange rates are based on a supply and demand relationship, especially for products like cash and traveller’s checks.

Conclusion

Although a foreign exchange may be confusing in today’s global marketplace, there is a critical need for almost everyone to understand foreign exchange like never before. As the world shrinks, there is an ever-increasing likelihood that requires addressing. The risks are accompanying by the fact that different currencies use all around. The world and these currencies have an immediate impact on the planet.

Moreover, one must be able to evaluate the effects of and actively respond to them. Moreover, there is an ever-increasing probability that one has to transact in these foreign exchange markets in their personal or professional life. But, this book intends to assist with this potentially new and doubtlessly confusing milieu.

Related Searches:

[continental currency services near me]

[continental currency exchange rates]

[continental currency services main office]

[continental currency services long beach, ca]

[continental currency services careers]

[continental currency services riverside, ca]

[continental currency services los angeles, ca]

[currency exchange near me]